Company Acquisitions

Our Service

We have extensive experience in advising both companies and individuals with the relevant managerial background on business acquisitions.

Our advisory services include an initial talk to agree on the success criteria for the acquisition and does not end until the transaction has been finalised and completed.

In connection with company acquisitions, we add significant value for our clients during both the analysis phase and when negotiating the final terms and conditions. In our role as external advisers, we contribute to creating an efficient negotiating climate and thus ensure a strong basis for the subsequent working relationship and integration of the companies.

Typical clients in connection with acquisitions:

- Companies which – due to their growth strategy or due to structural conditions in their line of business – see acquisitions as a strategically sound move to realise synergies through mergers – either in Denmark or internationally.

- Individuals with solid business experience who are interested in taking over companies that are ripe for succession – in the form of either a management buy-in (MBI) or a management buy-out (MBO).

- Foreign businesses wanting to establish themselves in Denmark.

- Private equity firms wanting to execute buy-outs or industrial consolidation.

Our buy-side process

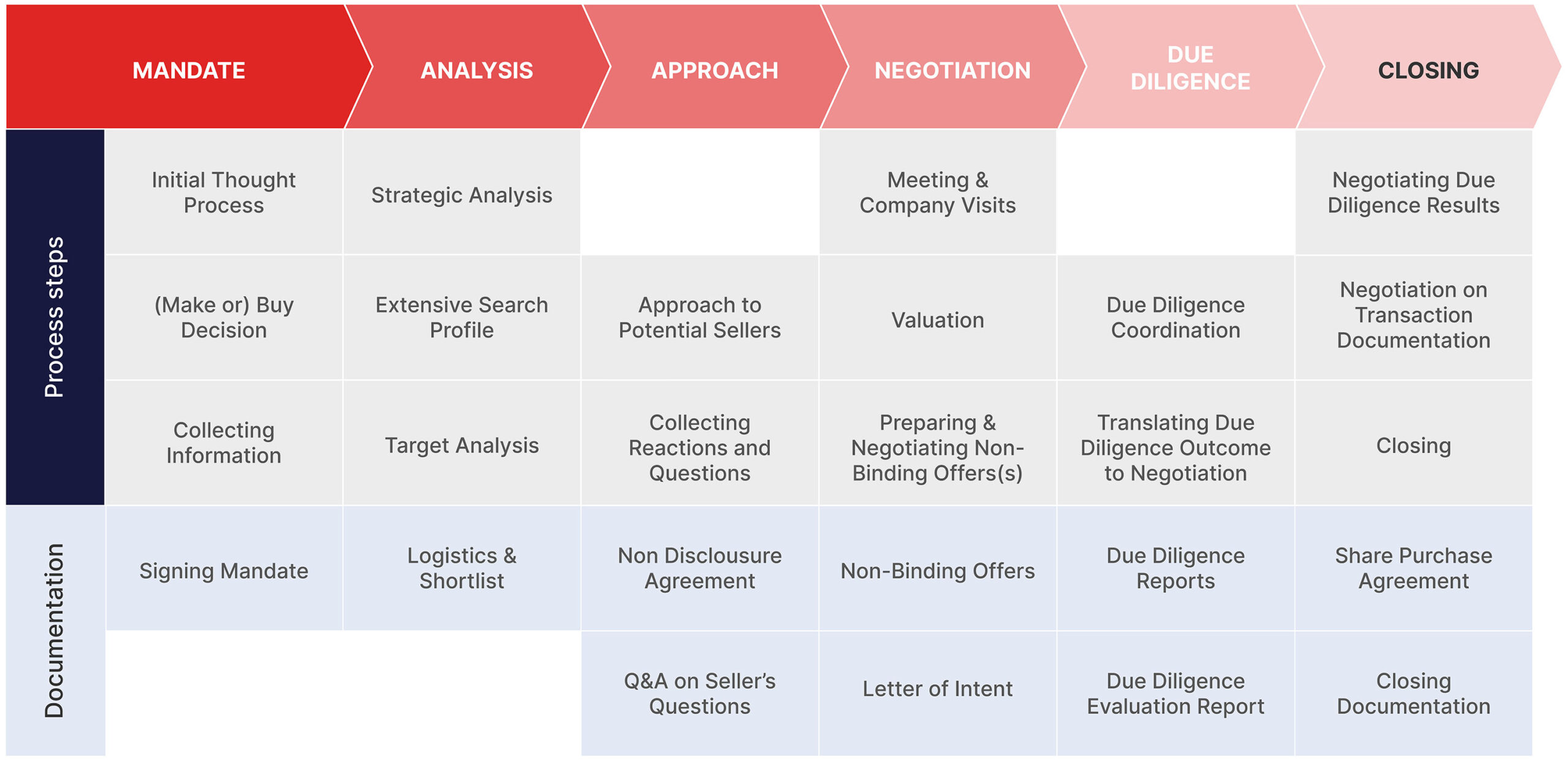

The acquisition process involves several phases and often extends over a long period of time. It is therefore advisable to begin preparations in cooperation with us as early as possible, to pave the way for a solution which is optimised from both a commercial, legal and financial point of view.

We manage the entire acquisition process, from the initial analysis of the buyer’s situation, the definition of success criteria, the identification of selected companies that are then contacted, to the final negotiations and structuring of the closing. This process is carried out in close cooperation with the buyers and the selected company’s other advisers, including accountants and lawyers.

The various phases of the acquisition process differ, depending entirely on the type of buyer. In other words, depending on whether it is an acquisition process for a company where the target company has not been identified, an acquisition for a working buyer (MBI), or the acquisition of a specific business, where the company has been identified by the acquirer (MBO, MBI, strategic acquisition).

Are you looking for professional advice?

Nothing found.